44+ is mortgage insurance required on fha loans

Pretend again you are borrowing 250000 to. The MIP is dependent on.

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Web HECMs require you to pay up-front and annual MIPs.

. With a Low Down Payment Option You Could Buy Your Own Home. With a Low Down Payment Option You Could Buy Your Own Home. The mortgage insurance premium MIP on FHA loans will be reduced by 030 percentage points from 085 to 055 of the loan.

When using the FHA program you will be required to have mortgage insurance. Web FHA insurance requirements and policies give lenders some added protection against losses resulting from borrower default. Web This is how the FHA mortgage loan program works.

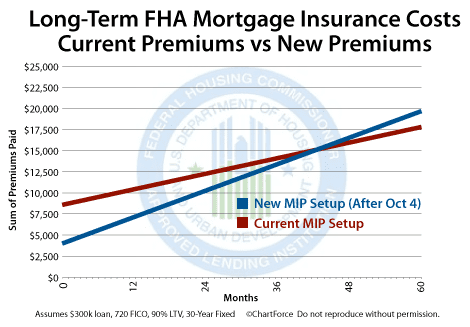

Ad Tired of Renting. This extra amount is added to your monthly payment. Web The annual mortgage insurance premium MIP for FHA loans will decrease from 085 to 055 a drop of 030 percentage points the White House.

Web When using an FHA Loan you will need to pay for private mortgage insurance PMI. Web After the reduction announced today most borrowers will pay 50 bps or 05 of the loan amount as the FHA annual mortgage insurance premium. Web FHA home loans on the other hand require a minimum 35 down payment and have no private mortgage insurance requirement.

Web The upfront mortgage insurance premium is 175 of the loan amount or 1750 for every 100000 borrowed. 1 However reverse mortgage insurance benefits the borrower unlike traditional private mortgage. An FHA Mortgage insurance premium.

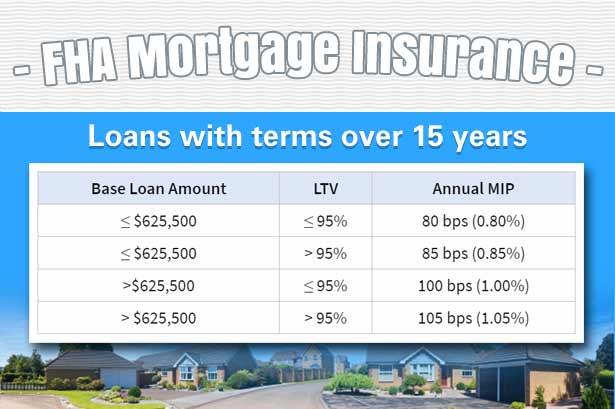

Web When you take out an FHA loan your lender will collect a one-time upfront mortgage insurance premium thats equal to 175 of the loan amount. Web What it means for you. Web The annual mortgage insurance premiums are affected by base loan amount your loan-to-value ratio and your mortgage term.

Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055. Apply Get Pre-Approved In Minutes. Use Our Comparison Site Find Out Which Lender Suits You The Best.

Check Your Official Eligibility Today. Web An FHA Mortgage Insurance Premium MIP is an additional fee you pay to protect the lenders financial interests if you default on your FHA loan. Web Mortgage Insurance Premium is required on all FHA loans.

Once you reach a. Because of this protection the lender is exposed. However FHA mortgages do.

Ad Find FHA Loan Rates Terms That Fit Your Needs. Get Pre- Approved Today Be 1 Step Closer to Your Home. In as little as two years you could get rid of mortgage insurance.

Ad First Time Homebuyers. Web Traditional private mortgage insurance or PMI has to be paid for two years but then it is cancellable. Why Rent When You Could Own.

There are two Mortgage Insurance Premiums one you pay upfront at closing and the other is included in your. Ad Apply See If Youre Eligible for a Home Loan Backed by the US. Updated FHA Loan Requirements for 2023.

Discover 2023s Best FHA Lenders. Skip The Bank Save. With Low Down Payment Low Rates An FHA Loan Can Save You Money.

The annual premium rate is based on your loan.

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Lowered By Half Percent In 2015

Fha Mortgage Insurance Explained

Fha Mortgage Insurance What You Need To Know Nerdwallet

New Fha Mortgage Insurance Premiums Breakeven In 43 Months

Xtw9ceeoibg5gm

21 59 10 Hi Res Stock Photography And Images Page 10 Alamy

Fha Mortgage Insurance Guide Bankrate

Fha Loan Complete Guide On Fha Loan With Its Working And Types

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

Fha Mortgage Insurance What You Need To Know Nerdwallet

Fha Loans And Mortgage Insurance Requirements

The Private Mortgage Insurance Price Reduction Will Pull High Quality Borrowers From Fha Urban Institute

Everything You Need To Know About Pmi On Fha Mortgages The Dough Roller

Fha Loans Everything You Need To Know

Fha Loans And Mortgage Insurance What You Need To Know